1. Types of Government Solar Incentives

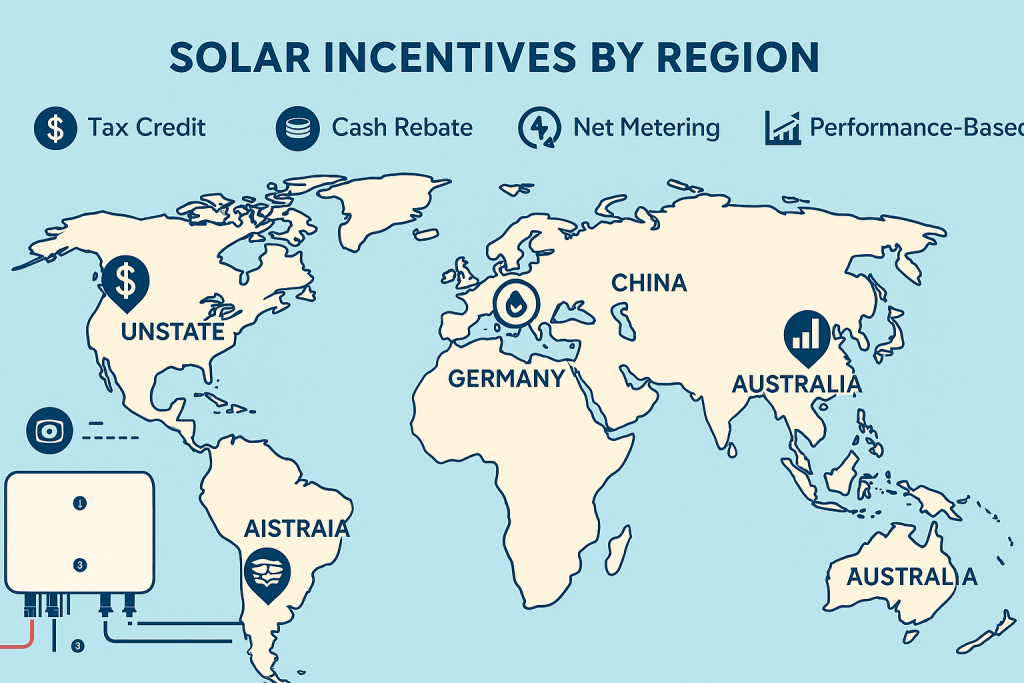

Depending on your location (e.g., the US, EU, Canada, or Asia-Pacific), there are generally four major categories of solar incentives:

✅ A. Federal Tax Credits

• 🇺🇸 U.S. Federal Solar Investment Tax Credit (ITC): Provides a 30% tax credit (2022–2032)

✅ B. State or Local Rebates

A cash subsidy provided by a state, city, or energy agency.

• For example, Germany, the Netherlands, and France provide direct equipment subsidies or low-interest loans

✅ C. Net Metering Programs

Feed your unused solar electricity back into the grid and receive bill credits from your power company.

• For example: Spain, California, Australia, etc.

✅ D. Performance-Based Incentives (PBIs)

Rewards are given based on the actual amount of electricity you generate, such as a fixed amount of subsidy per kilowatt-hour.

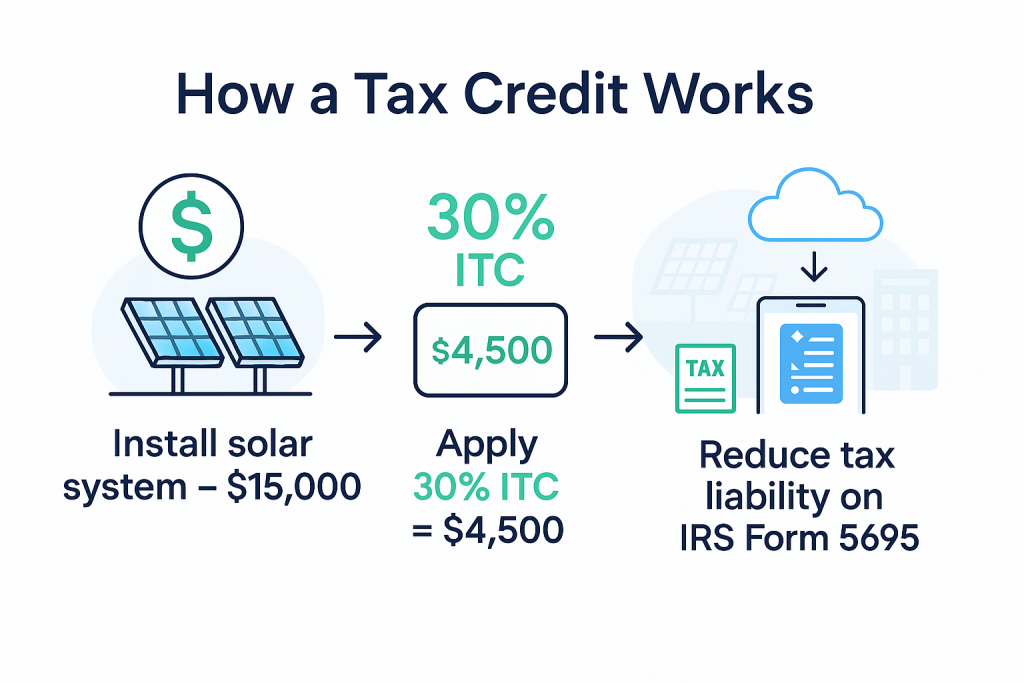

2. How Tax Credits Work in Practice

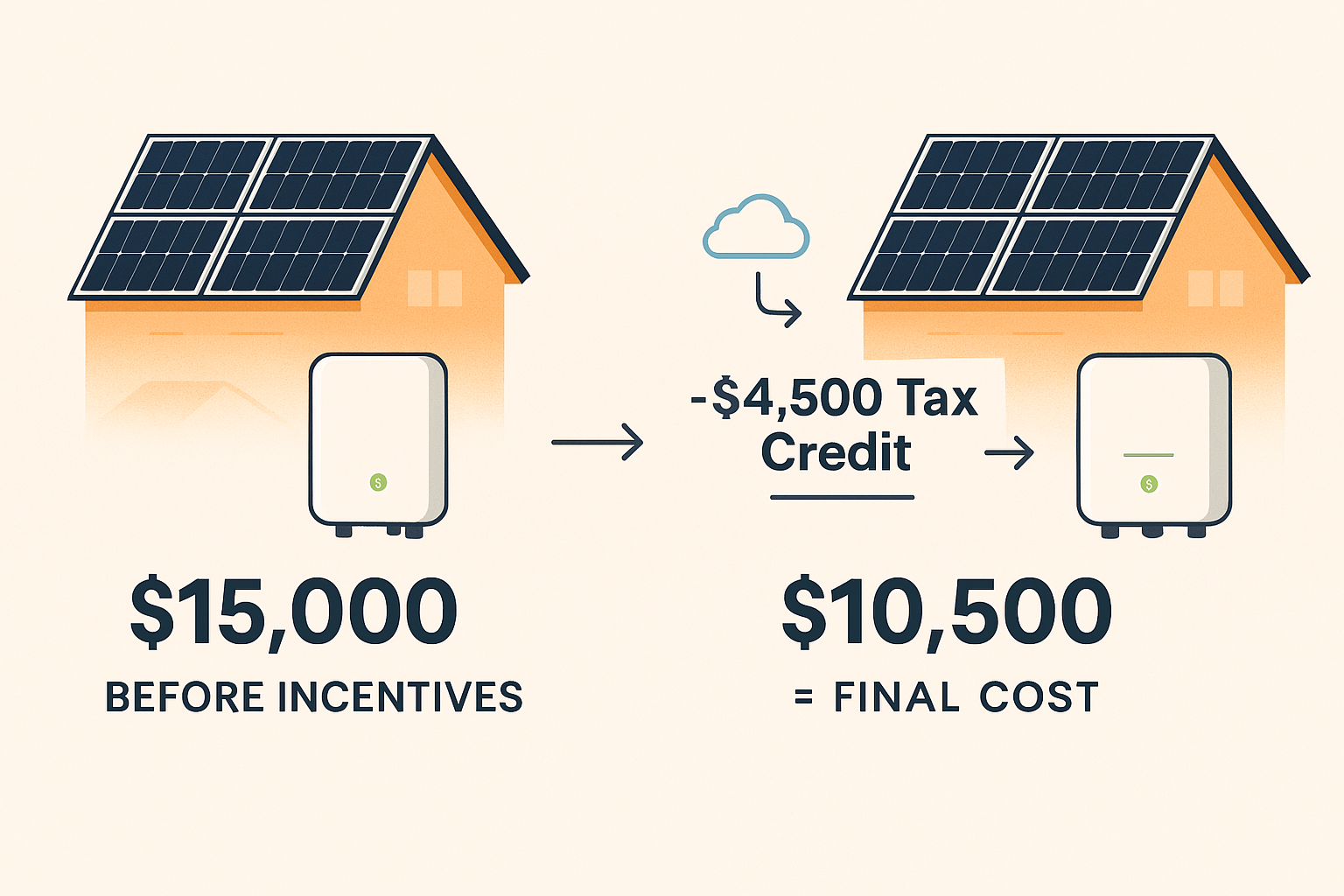

Let’s take the U.S. federal tax credit (ITC) as an example:

• Suppose your solar system costs $15,000 USD

• You are eligible for a 30% tax credit

• That means you can deduct $4,500 from your federal income taxes

⚠️ Note: The credit only applies to individuals/enterprises with tax obligations. If the credit is not fully deducted in the current year, it can be carried forward to future tax years for continued deduction.

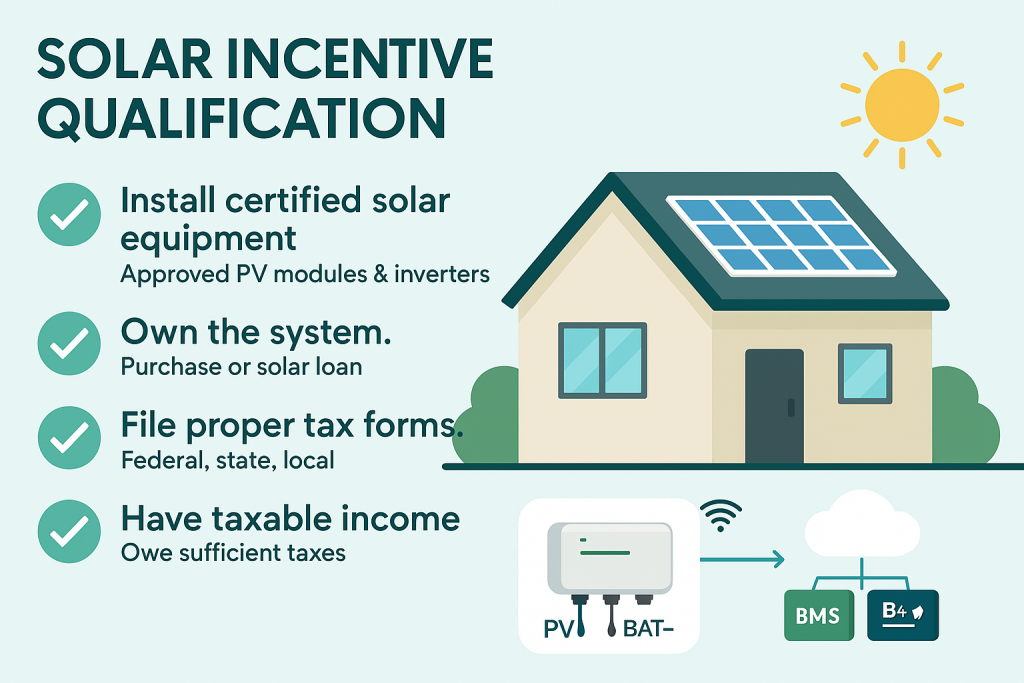

3. How to Qualify for Solar Incentives

To benefit from government programs, make sure you meet the following criteria:

| Requirement | Explanation |

|---|---|

| ✅ Install qualifying equipment | The solar panels and inverters must be certified products (e.g., UL, CE, TUV listed). |

| ✅ Own the system | You must own the solar system — systems under lease agreements typically do not qualify. |

| ✅ File the correct forms | You need to submit the proper application forms, such as IRS Form 5695 in the U.S. |

| ✅ Have taxable income | Only individuals or entities with taxable income can benefit from tax credit programs. |

4. Tips to Maximize Solar Incentive Benefits

📝 Work with Certified Installers

Choose certified installers, who usually understand all local subsidy policies and can assist with document submission, filing and other processes.

📆 Install Before Deadlines

Some incentive policies are time-limited, such as the US ITC policy, which will begin to decline in 2032.

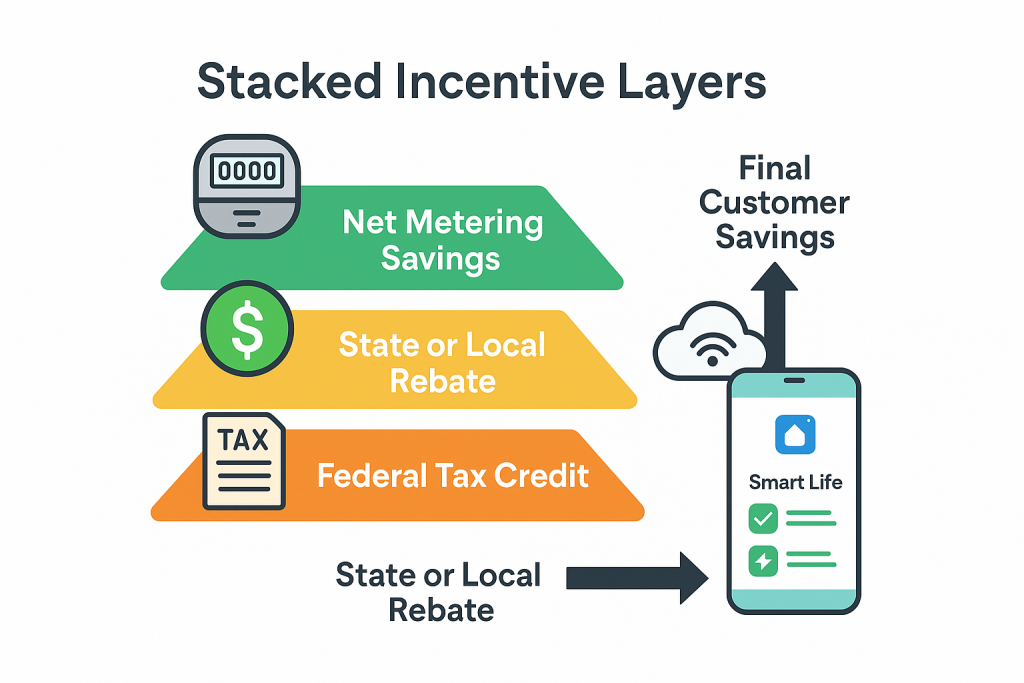

💬 Combine Local + Federal

You can stack federal credits + local subsidies + green power funds at the same time to save more.

🧾 Keep All Invoices

Make sure to retain all invoices, contracts, system parameter certificates and other materials for audit or reporting purposes.

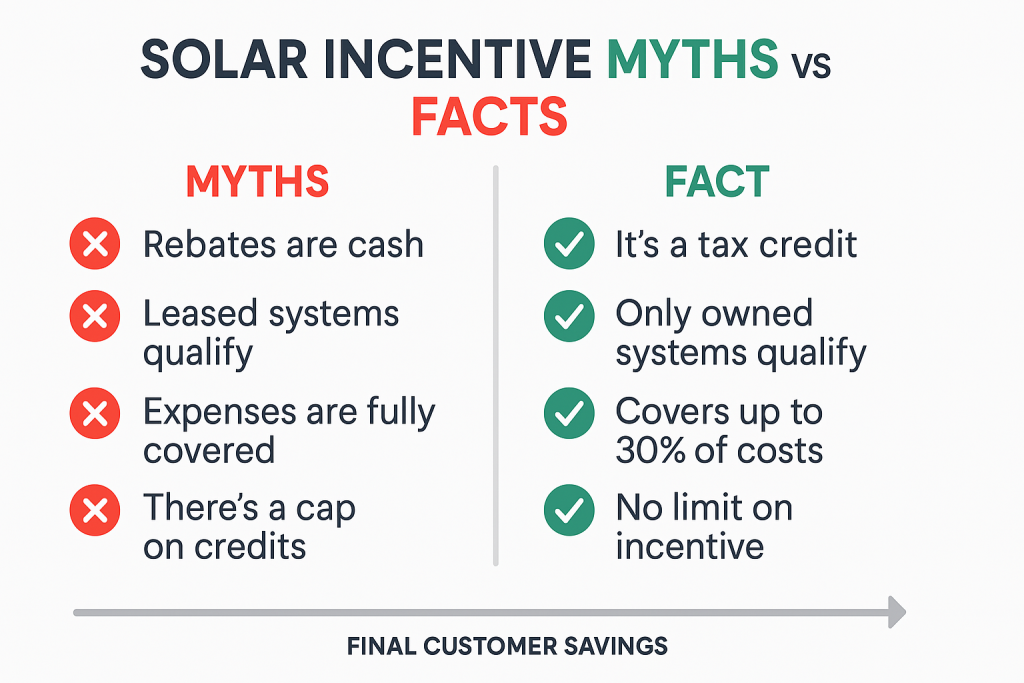

5. Common Misconceptions to Avoid

❌ “Subsidies are cash back” → Actually tax credits, not direct cash

❌ “Leasing systems can also enjoy incentives” → Only self-owned systems can apply for most incentives

❌ “The more expensive the system, the more credits” → Reasonable planning is required to avoid over-installation of unnecessary capacity

✅ “DIY users can also apply for credits” → Some areas allow individual installation as long as they meet the certification conditions

Conclusion: Don’t Miss Out on Free Money

With the right planning, you can significantly lower the cost of going solar by taking advantage of tax credits, rebates, and net metering. Consult with a professional installer or local authority to ensure you meet eligibility requirements and file properly.